Many people are confused about how the information on their driving record may differ from what is found on their insurance policy. The points you accrue on your North Carolina driving record may not be the same as the points your insurance company assigns to your policy to determine your rates. Below I will tackle driving record points first, and then I will explain insurance points and the relationship between the two.

How Do You Get Points on Your DMV Driving Record?

The North Carolina Division of Motor Vehicles (NC DMV) assigns points to your driver’s license when you are found at-fault in an accident or are found guilty of a traffic violation. If you accumulate a certain number of NC DMV points, you can have your license suspended or revoked.

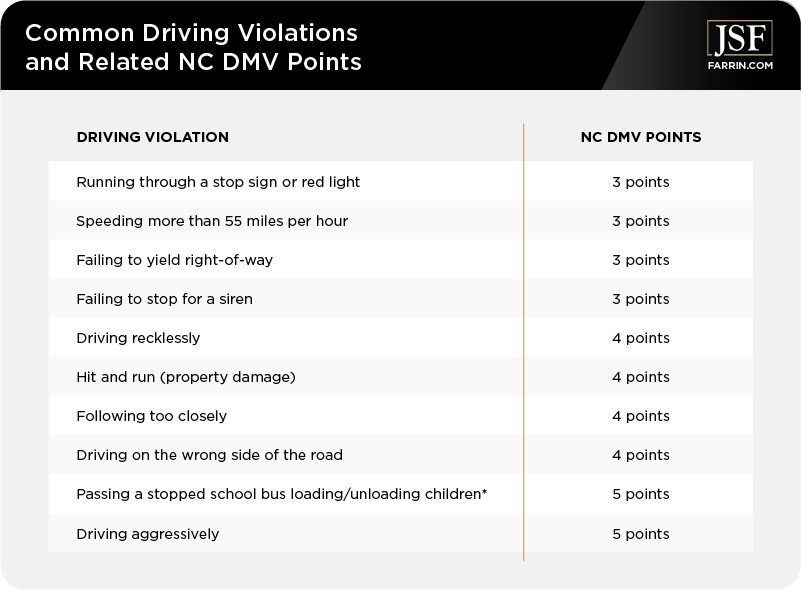

Some common violations and their related at-fault accident points include:

*Read When to Stop for School Buses in NC (And WHY)! for more information about NC law surrounding school buses.

If you get 12 or more points within a 3-year period, your license may be suspended for up to 60 days. If you get eight points within three years of the reinstatement of your license, your license can be suspended for up to six months. And a third or subsequent suspension can result in a year-long suspension of your license.

You can see the status of your license and the number of points assessed on your driving record through your MyDMV account.

The bottom line is: If you accrue too many points in too short a time period, your driving privileges may be suspended or revoked.

How Long Do Points Stay on Your License in NC?

Generally in North Carolina, points stay on your license for three years. If you do not get additional points during that time, your points should go away. You can also potentially take a North Carolina defensive driving course to reduce points on your license quicker.

Will Points on My License Make My Car Insurance Premiums Go Up?

While insurance companies do not directly use your driver’s license points to determine your rates, your premium will likely increase when you are issued license points. Insurance companies research many different factors when determining your rate, such as your driving history, your motor vehicle report (MVR), your Comprehensive Loss Underwriting Exchange report (C.L.U.E.), and your record of prior insurance claims.

How do points affect your car insurance? The answer is not an exact one. But the possibility of a rate increase rises with the more driving infractions the car insurance company find.

Do I Need to Tell My Insurance About Points on My Driving Record?

No, you do not need to tell your insurance company about points on your driving record, but it will probably find out on its own eventually. Some insurance companies may not pay the fee to access your MVR until your policy is up for renewal, or if you increase your coverage, or if you purchase a high-performance vehicle. Others have a practice of checking their policy holders’ records after a certain amount of time has elapsed, such as every two years.

How Do Insurance Points Work in North Carolina?

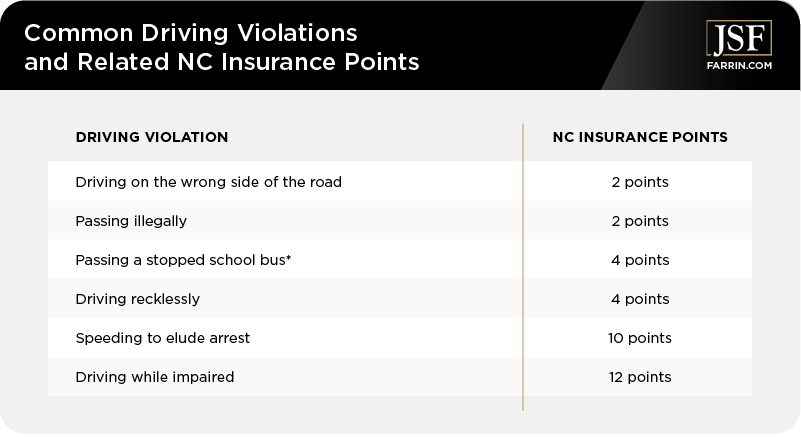

The Department of Insurance determines the insurance point system in NC that is used to calculate your insurance rates, and these points are completely separate from the points the NC DMV uses. The points your insurance company uses are based on accidents, liability claims against you, and any other incidents in which you were found at-fault and your insurance company had to pay a claim.

Some common driving violations and their related NC insurance points include:

*Read When to Stop for School Buses in NC (And WHY)! for more information about NC law surrounding school buses.

How Do Insurance Points Affect Insurance Premiums?

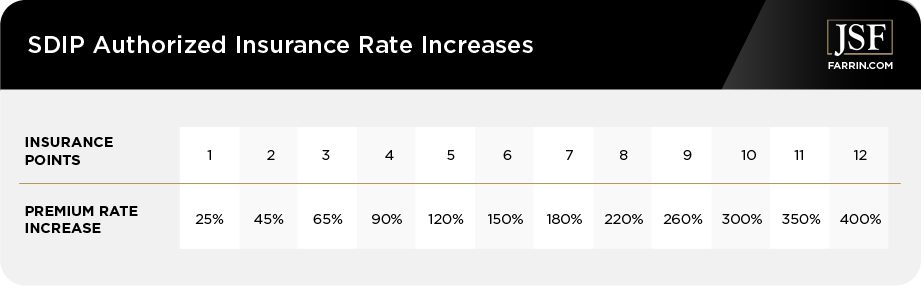

In North Carolina, there is a Safe Driver Incentive Program (SDIP) that awards safe drivers with lower insurance rates. For each insurance point you accrue, your insurance rate increases. The SDIP authorized insurance rate increases follow:

Does Removing License Points Lower Your Insurance Premiums?

Not necessarily. But having points removed from your drivers’ license may help prevent your rates from increasing in the future.

Personal Injury Lawyers Who Know the Ins and Outs of the NC Point System

Under the North Carolina system, it is possible for you to have a driving ticket dismissed and to not receive any points on your driving record, but still have points counted against your insurance policy. It’s tricky, to say the least. And dealing with the at-fault driver’s insurance company can make things even trickier.

Of course, the best way to keep your insurance rates down is to practice safe driving and to maintain a clean driving record.

If you have been injured in an accident, you may be entitled to legal compensation for your injuries. Several attorneys on our team have worked for insurance companies and know the tactics and strategies some may use to delay and deny claims.

Contact the Law Offices of James Scott Farrin at 1-866-900-7078 for a free evaluation of your case to find out if one of our North Carolina personal injury attorneys may be able to help you.

You May Also Be Interested In

If You’re Just 1% at Fault for Injuries, Insurance May Give You Nothing. What You Can Do?

Car Insurance Myths and Facts (and Recommendations From a Former Claims Adjuster)

Car Accident Settlements: How to Negotiate with Car Insurance Adjusters About Car Total Loss