As a driver in most states, you’re required to have at least a minimum amount of insurance in the case of a crash, though some people flout that rule at their peril. Many, if not most, insurance policies have a deductible – an amount that must be paid before coverage begins.

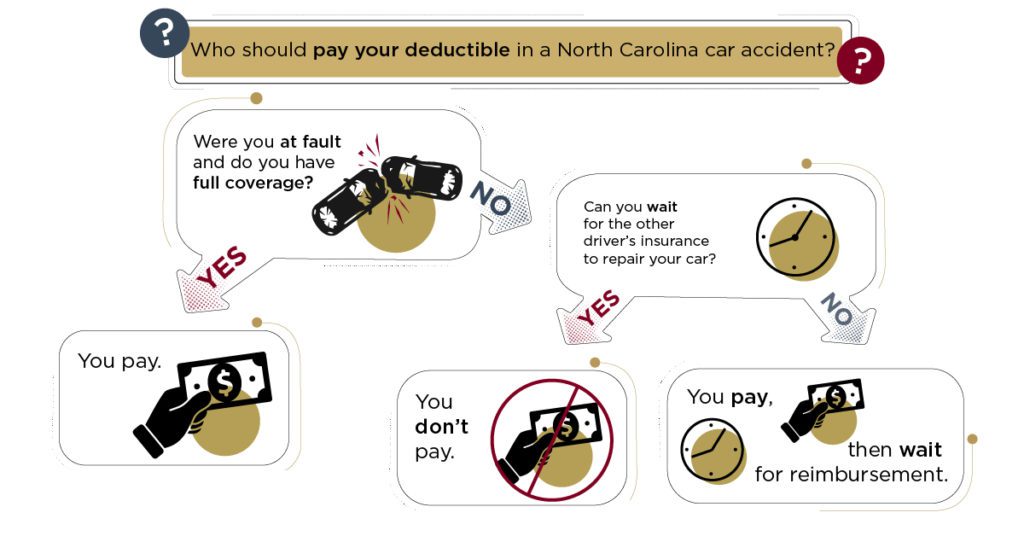

So who pays that deductible if there is a car accident? That depends on a number of things that all work together – who files the claim, who was at fault, state law, and perhaps your willingness or ability to wait. The requirements should be spelled out in your policy documents. Here is some essential information.

If You’re at Fault in the Crash, Who Pays the Deductible?

If you’re at fault in a crash and have full coverage, then you pay the deductible and your insurance fixes both cars up to the policy limits. If you have base liability and underinsured/uninsured motorist coverage, your insurance will fix the car of the person you hit up to limits, but not yours.

Let’s say you’re in an accident and your car is damaged. Assuming you have full coverage, if you’re at fault in the crash, you’re going to have to pay your deductible to have your car repaired. There’s no way around it. You do NOT pay the other driver’s deductible. Your insurer handles the repairs to the other driver’s vehicle up to limits. You can probably expect your premium to rise when your current policy expires.

If You’re NOT at Fault in the Crash, Who Pays the Deductible?

If you’re not at fault in the crash, you do not have to pay a deductible. The at-fault driver, if they have full coverage, has to pay the deductible for their own car’s repairs, but not to have yours repaired. Their insurance should cover your vehicle up to policy limits and you pay no deductible. But this is where people get confused.

First, you can wait for the at-fault driver’s insurance company to repair your car. In this case, you won’t be paying your deductible because you’re not claiming against your policy. The catch is that the other insurance company can take a long time to finally pay out and repair your vehicle or compensate you if it is totaled. The at-fault insurance company will typically have to cover a rental vehicle or pay for your loss of use for the time you aren’t able to drive your vehicle.

Second, you can initiate a claim with your insurer, pay your deductible, and have your car repaired more quickly (though not necessarily without some waiting). Your insurer can then seek reimbursement from the at-fault driver’s insurer through a process called subrogation. That can take more time than simply going through the at-fault insurance company for the repairs, but when it’s over, you should be reimbursed your deductible once your insurance company has been compensated.

Third, even if you have full coverage, you may be waiting for an adjuster or appraiser to look at your car and to schedule repairs with a shop. Also be aware that full coverage does not necessarily include rental car coverage. If your policy does not include it, you may still need to go through the other driver’s policy.

What if There Was an Injury in the Crash? Does That Affect the Deductible?

Your car insurance deductible applies to repairs to your vehicle or compensation for it if it’s totaled – if you have what most people refer to as comprehensive and collision coverage. An injury to you or the other driver (or both) has nothing to do with your deductible.

If you’re at fault and have full coverage, for example, you’ll pay the deductible to get your car repaired. The liability coverage of your policy will pay for the other driver’s property damage (the vehicle, for example) and medical bills up to policy limits. If you’re not at fault, your vehicle and injuries should be covered by the other driver’s liability coverage.

If the other driver is not insured, your own policy’s uninsured/underinsured motorist coverage can kick in.

Remember: If You File a Claim On Your Policy, You Pay the Deductible!

Here is a simple way to remember it. You don’t pay anyone else’s deductible. If you file a claim on your own policy, you pay your deductible. However, just because you pay it doesn’t mean you can’t get it back. It just may take a long time for the insurance company to subrogate – to collect the money you paid from the other driver’s insurer. Most people cannot afford to be without their car for as long as it may take to go through the at-fault insurer, so many choose to file a claim on their own coverage, pay the deductible, and wait for their insurer to pursue reimbursement.

Should I Hire an Attorney for My Car Accident Claim?

That depends. Many attorneys do not take cases that solely involve damage to vehicles, as representation cannot generally make enough difference to make the time worth the cost to you. The costs of repairs is relatively easy to establish, as is the “Fair Market Value” of a vehicle, so representation is typically not as beneficial as it can be in other, more complex situations such as a crash that results in an injury. But there are still times when the insurance carrier isn’t being fair and you can benefit from representation in seeking just the vehicle damage.

However, if you’re injured in an accident by another driver, the deductible may be the least of your worries, and you should absolutely consider hiring an experienced personal injury attorney to help you deal with the insurance company. We’ll also negotiate for the damage to your vehicle, including a diminished value claim if applicable. The insurance company does not represent you or your best interests. An attorney, on the other hand, is looking out for you.

You May Also Be Interested In

Answers to the Most Frequent and Urgent Car Accident Injury Questions

Who Pays for Physical Therapy After a Car Accident?

Whose Insurance Pays for Car Accidents?