Are there specific NC laws for salaried employees? What about for exempt employees? And what’s the difference between a salaried employee and an exempt employee? As a North Carolina employment law attorney, I hear many questions like these. And most of the time, people are trying to get a handle on whether or not they are eligible for overtime pay.

Below I have answered some of the most common questions I have been asked by exempt workers who are unsure whether their employers are treating them fairly, or even classifying them accurately. I’ll start with an overview of the NC exempt employee guidelines and then drill down into more detail as the questions get more specific.

My intent is to explain a bit about the basics of NC labor laws on overtime exemption to help you understand what your rights are as an exempt employee. If you need guidance in protecting those rights, please contact the Law Offices of James Scott Farrin for a free case evaluation. We are here to help.

What Is an Exempt Employee and Who Falls Into This Category?

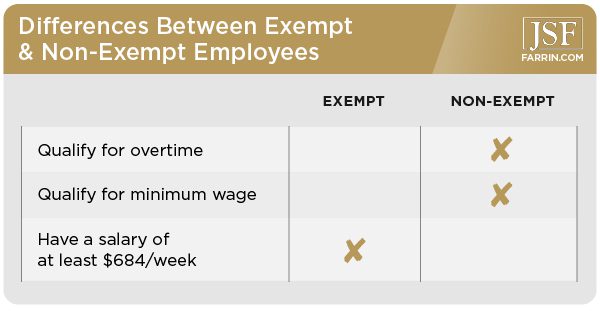

Exempt employees are workers who do not qualify for federal Fair Labor Standards Act (FSLA) provisions, which means that:

- They aren’t required to make at least the federal minimum wage for all hours worked

- They don’t qualify for overtime pay of at least time and a half of regular pay for all hours worked over 40 hours in a workweek

The North Carolina Wage and Hour Act (NCWHA) follows these same federal guidelines.

To be an exempt employee, you must meet all three of the following qualifications in North Carolina:

- You must be salaried.

- This means you must have a consistent and designated rate of pay regardless of how many hours you work.

- Your salary must be at least $684 per week or $35,568 per year.

- If you are a “computer-related” employee, you may be paid $27.63 per hour instead.

- Your job must meet a specific duties test.

- Your position must include specific duties assigned to “white collar” employees (executive, administrative, or professional), “computer-related” employees, or “outside sales” employees.

Do not be fooled by your title. Just because you have been given the title of “manager” does not mean you automatically fall under the “white collar” exempt classification. The law requires examination of your job responsibilities, in addition to your title, to determine if you are exempt from wage and overtime laws.

The following are some of the factors considered:

- Do you regularly supervise two or more employees?

- Do you have the power to hire and fire employees?

- Is your opinion on personnel matters given additional weight?

- Do you primarily work with customers?

If you have the title of “manager” and your employer has classified you as exempt, but you are spending less than half of your time at work performing some of the above tasks, your classification may be wrong. You may be entitled to recover wages if your employer has misclassified you as an exempt employee. Call the Law Offices of James Scott Farrin at 1-866-900-7078 for a free case evaluation.

Salaried Does Not Mean the Same Thing as Exempt

You can be salaried and exempt, but these words are not synonymous. Salaried refers to the payment structure of being paid a fixed amount of money per year. And this is only one of the three requirements of being exempt. Exempt refers to not being eligible to receive overtime pay or qualify for minimum wage. To be exempt, your job must meet the $684/week minimum requirement and meet the duties tests described above, in addition to being salaried.

There is a common misperception that all non-exempt employees are paid on an hourly basis. Under the FLSA, non-exempt employees can be paid hourly, salaried, piecemeal, on commission, etc. as long as their weekly pay equals at least minimum wage for hours worked.

Therefore, you can be salaried and non-exempt at the same time. For example, if you are paid a weekly salary of at least $290 (minimum wage of $7.25/hour x 40 hours) and your employer designates you as a “salaried, non-exempt” employee, you could still be entitled to overtime pay under the FLSA even though you are salaried.

You cannot be paid hourly and exempt at the same time because being salaried is one of three qualifications you must meet to be exempt.

Types of Exempt Occupations

In general, occupations that involve “white collar” duties are exempt if they are salaried and make more than $684/week. This can include teachers, human resources administrators, scientists, executives, managers, artists, inventors, lawyers, and doctors. In some instances, jobs involving “outside sales” or “computers” that have a $684/week minimum salary may be exempt, as well.

There are multiple industries that you may assume have non-exempt employees that instead generally have exempt employees. These include:

- Farm workers (as long as they are not minors)

- Seasonal amusement and recreational businesses workers

- Fishing, railway, and transportation services employees

- Apprentices

- Workers with disabilities

- Employees of small newspapers

- Broadcasters

- Live-in domestic workers

- Many others that may not seem intuitive

Do Exempt Employees Get Overtime?

No, if you are an exempt employee in North Carolina, you do not qualify for overtime pay.

There are good and bad things about being an exempt employee. On the positive side, you generally will earn more money as an exempt employee than you would if you are working at a non-exempt job. If you break down the minimum wage level for exempt employees ($684/week) to an hourly amount ($684/40 hours = $17.10/hour), you will be paid above the $7.25/hour minimum wage as an exempt employee unless you work 94 hours a week.

However, it also means that you are not eligible for overtime and your employer can pay you less than minimum wage. If you work 40 or 100 hours, you would still get paid the same thing. That may mean that you may work a lot more hours as an exempt employee without additional compensation.

If you are non-exempt, you may get a lower wage, but the law states that you will at least get minimum wage for each hour worked and that you are paid time and half for any hours over 40. That also means your employer may think twice before asking you to work more than 40 hours.

What Laws Are Specific to North Carolina’s Exempt Employees?

The public policy behind the NCWHA is to “protect those who, as a matter of economic reality, are dependent upon the business to which they render service.” State law largely mirrors the FLSA, but has additional protections.

For example, North Carolina exempt employee laws require that employers generally must:

- Prove that an employee is exempt by “clear and convincing evidence”

- Pay wages when due and on a regular pay day

- Provide 24-hour prior notice for reduction in pay and must provide notice of compensation policies and practices

- Pay accrued vacation pay

Employers are not generally required to pay exempt employees overtime, comp time, or minimum wage or provide paid-for breaks under NC and federal law. The employer is actually “exempt” from following those laws.

When Can Employers Not Pay an Exempt Employee?

This is an important question. North Carolina labor laws for exempt employees state that an exempt employee must be paid “a predetermined amount constituting all or part of their compensation … without regard to the number of days or hours worked.”

If your employer is deducting amounts from your paycheck for things such as lost equipment costs, time away from work for personal reasons, jury duty, or other things, this may be a sign that you have been misclassified as exempt.

There are valid deductions your employer can make to your pay, according to the law for NC exempt salaried employees. The Wage and Hour Division of the U.S. Department of Labor lists the following valid circumstances in which an employer may make deductions from an exempt employee’s pay:

- Penalties imposed in good faith for infractions of safety rules of major significance

- Unpaid disciplinary suspension for violations of workplace conduct rules, such as sexual harassment or workplace violence

- Theft, which if proven, can also reduce your wage below minimum wage

- To offset amounts received as a jury member or witness, or for military pay

- Full salary for the first or final week of employment

- One or more full-day absences for a personal reason other than sickness or disability

- One or more full-day absences due to sickness or disability if the deduction is made according to a bona fide plan, policy, or practice of providing compensation for salary lost due to illness.

In addition, employers may generally make pay deductions for exempt and non-exempt employees for the reasonable cost of furnishing employees with board, lodging, meals at a company restaurant, dorm rooms and tuition for student employees, general merchandise furnished at a company store, and fuel and transportation for personal use. Employers are also not required to pay bonuses that have not accrued at the time of the employee’s last day.

What Are Invalid Deductions for Exempt Employees?

If you are an NC salaried exempt employee and your employer made deductions from your pay for the following circumstances, your rights as an exempt employee may have been violated:

- Absences caused by your employer or by the operational needs of the business (such as your boss closing the store early because there are no customers that day)

- Absences for sickness or disability, unless it is part of an unpaid FMLA claim

- Deductions for the quality or hours of work performed (unless for a full day off for personal reasons or FMLA leave)

- Deductions for lost or broken equipment

Employers are not generally permitted by law to deduct pay from any employee (exempt or non-exempt) for any equipment, tools, or uniform required by the employer or for transportation costs that are a part of the job.

How Many Hours Can a Salaried Employee Be Forced to Work in North Carolina?

There is no maximum limit to the number of hours a salaried employee can be asked to work.

North Carolina law does not set the maximum hours that exempt, or salaried, employees are allowed to work in a day. The important distinction is not whether someone is salaried, but whether they are exempt or non-exempt.

Are There Any Protections for Exempt Employees?

Yes, exempt and non-exempt employees are equally protected by all employment laws – with the exception of overtime and minimum wage provisions which only apply to non-exempt employees. That means that the anti-discrimination employment laws (such as Title VII of the Civil Rights Act, ADEA, EPA, ADA, PDA), FMLA, OSHA, workers’ compensation, unemployment compensation, and retaliation laws for reporting violations of the law, as well as many other laws, still protect exempt employees.

At the Law Offices of James Scott Farrin, we can help you fight for your rights as an exempt employee and provide guidance on next steps if you’ve been misclassified by your employer. Call us today at 1-866-900-7078 or contact us online for a free case evaluation.

You May Also Be Interested In

North Carolina Employment Law: What You Need to Know

Can You Be Fired for Being Sick in NC? The Answer May Surprise You

What Is Considered Full Time in NC? The Answer May Surprise You