This page refers to Rideshare and Delivery Accidents in North Carolina.

Since laws differ between states, if you are located in South Carolina, please click here.

Rideshare and Delivery Drivers and Insurance:

Who Takes the Hit in a Wreck?

Someone taps to summon a ride home, or to order some food from their favorite delivery service app. The driver gets the message and heads to pick up the passenger, or grab the meal and deliver it. Somewhere along the way, that driver causes a wreck. What happens next?

The question seems simple enough, but due to the nature of these rideshare and delivery apps, it’s more complex than you think. Let’s dig in.

For a free case evaluation of your particular situation, call on our award-winning attorneys at 1-866-900-7078.

Car Insurance Complications for Rideshare and Food App Delivery Drivers

Many states have adopted rules and insurers have created new products to cover the rapidly evolving “gig” economy, which includes people who drive for rideshare and delivery apps. What many do not know is that ordinary car insurance does not cover a driver working for a rideshare or delivery service.

If you read your insurance policy, for example, you’re likely to find a section that deals with “livery” or “commercial use” of your vehicle. Specifically, the policy excludes such uses from its umbrella of coverage. Drivers may be delivering food or people, but the underlying principle is the same.

Livery vehicle: “A ‘livery vehicle’ remains a legal term of art in the U.S. and Canada for a vehicle for hire, such as a taxicab or chauffeured limousine, but excluding a rented vehicle driven by the renter.”

Commercial use: Transporting goods or people, or conducting a service from your vehicle, among other things.

These types of uses involve different risks to vehicle drivers and owners, and as such, their coverages will differ. This matters when a driver is not carrying the correct type of insurance for the work they’re performing. Given the confusion about policies and terms of service, one can safely assume that drivers working for delivery services could have a higher rate of underinsurance or lack of an adequate policy.

None of this matters until the driver is at fault in an accident. If you’re injured by that driver’s error, it certainly matters to you, and you should consider contacting an experienced attorney to unravel the insurance questions.

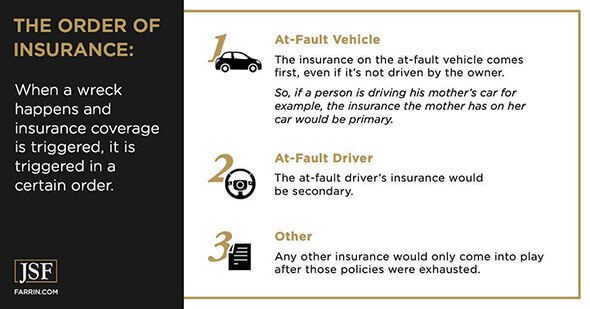

The Order of Insurance

When a wreck happens and insurance coverage is triggered, it is triggered in a certain order. The insurance on the at-fault vehicle comes first, even if it’s not driven by the owner. So, if a person is driving his mother’s car for example, the insurance the mother has on her car would be primary. His insurance, as the driver, would be secondary. Any other insurance would only come into play after those policies were exhausted. If he was driving his own car when he caused the accident, then his insurance as the driver and the vehicle’s insurance are one and the same. In the examples to follow, “driver’s insurance” assumes the driver owns the vehicle being driven.

Uber and Lyft: How They Insure Their Drivers (and Passengers…?)

The first thing you need to understand about how Uber and Lyft insure their drivers is how they classify the different phases of the work. Both, thankfully, use a three “period” system to classify the parts of a drive, so it is relatively easy to compare them directly.

PERIOD 1: The driver is logged into the app and waiting for a ride request. Uber does not provide any protection or insurance for their drivers during period one. The driver’s own insurance policy is all that’s covering them if they cause an accident. Since no coverage is coming from the service, the amount of available insurance coverage could be small. Combine this with the fact that, if the driver is relying on a personal insurance policy to cover him or her while operating as a rideshare driver, there may be no coverage at all. Most personal auto policies do not cover commercial or livery work (see below).

PERIOD 2: A request for a ride has been accepted and the driver is en route for pickup. Uber and Lyft begin offering coverage for their drivers during this period, but remember that the driver’s insurance policy will be the primary policy in the event of an accident. Only when those policy limits are reached will the service’s policy come into play.

PERIOD 3: The driver has picked up one or more passengers and is driving to their destination. The difference between periods two and three is the presence of passengers in the vehicle, which increases the number of at-risk parties in the event of an accident.

There could be many complicating factors. It’s best (and easy) to get a free case evaluation from one of our battle-tested attorneys if you were injured in an accident with one of these drivers.

What Do Uber and Lyft Policies Cover?

Once the driver is in period two or three, Uber and Lyft offer additional coverage that kicks in after the driver’s own policy.

Uber’s Policy:

PERIOD 2 – Uber provides additional coverage. This coverage only applies if the driver requests it, and only in the event that the driver’s own insurance policy is insufficient to cover the damages.

PERIOD 3 – When the Uber driver is carrying a rideshare passenger, both are covered under Uber’s policy. Additionally, if a third party is injured, like another driver, pedestrian or someone on a bicycle, they are also covered by Uber’s policy. If Uber denies coverage, then it will fall to the driver’s policy. If the policy does not include rideshare coverage of some kind, it may also be denied leaving the driver on the hook for every dime of damage to all parties!

Lyft’s Policy:

PERIOD 1 – Unlike Uber, Lyft does provide some coverage in period one. However, like all cases involving the services’ policies, it likely only comes into play after a driver’s own coverage is exhausted. Nonetheless, Lyft provides coverage per accident during period one.

PERIOD 2 – Lyft provides additional coverage in most states, and only in the event that the driver’s own insurance policy does not apply.

PERIOD 3 – Lyft offers third-party liability coverage. They provide blanket uninsured/underinsured motorist bodily injury coverage as well as contingent comprehensive and collision coverage for up to the cash value of the driver’s car. The contingent coverage comes with a deductible. These coverages likely only apply after the driver’s policy, as usual.

Renting to Rideshare – An Insurance Loophole?

There are plenty of options available for rideshare drivers, and one that you might hear about is the idea of renting a car from the rideshare service or a rental company. While the financial sense of this tactic is heavily debated, it does affect the insurance discussion: Insurance coverage is included as part of the rental policy. In the event of an accident, that coverage (on the vehicle) would be primary. This enables a driver to obtain rideshare insurance (of a sort) without involving his or her own personal policy, which would deny coverage due to the exclusions on commercial use.

If a Delivery Driver Is at Fault in an Accident, How Are the Non-Fault Parties Covered?

If you’ve been hit and/or injured in a wreck caused by a delivery driver for one of the app-based services, you have options. The quest for compensation begins with the at-fault vehicle’s insurance. As previously noted, this may not be much help if the driver was underinsured or did not carry the correct type of coverage for the activity in which he or she was engaged.

Some of the apps offer additional coverage for their drivers, though the policies are not created equal, and they do differ from rideshare drivers’ coverage. And, in some states, the rules may differ greatly. The apps are updating their policy offerings and rules fairly often, so an experienced attorney may be a good way to navigate the many differences, nuances, and policies involved. Generally speaking, though, here is what you can expect in North Carolina.

DoorDash

DoorDash provides its drivers with a contingent liability policy. However, the policy only covers drivers in the “Delivery Service” period. In other words, they’re covered from when they accept a delivery order until that order is complete. Additionally, the policy only kicks in after the driver’s personal policy is exhausted.

GrubHub

Drivers for GrubHub receive no additional insurance whatsoever.

Amazon Flex

Drivers for Amazon Flex have primary liability coverage including contingent comprehensive and collision coverage and underinsured/uninsured motorist coverage. This policy covers drivers who are “actively driving and delivering.”

Postmates

Postmates offers its drivers contingent liability coverage, except the coverage applies from the time a driver accepts a delivery through the time the delivery is completed. They also include a similar policy for deliverers who work on foot or ride bicycles and offer an optional occupational policy to cover injuries sustained on the job.

Instacart

The grocery shopping and delivery service offers no additional insurance to its drivers whatsoever but offers them the opportunity to buy insurance from partners.

Can I Sue the Rideshare or Delivery Service?

Now, in the case that there was some sort of corporate negligence, that would enable you to go after their corporate policy without relying on that of the driver. For example, if the company was negligent in its screening of drivers, or allowed drivers to work more than a certain number of hours, that could be considered negligence.

Why You Need the Right Insurance if You’re a Delivery Driver

You’re in a risky business. When you go to work for these delivery services, you’ll be handed a contract, and if you read it carefully, you’ll find out you’re probably not an employee. You’re likely an independent contractor.

As an independent contractor, you’re on your own in a great many ways. Foremost is that you’re using your vehicle for the purposes of the delivery service. As stated above, most personal auto insurance policies specifically exclude such uses for purposes of coverage. You should contact your insurer and ask them what would be required to obtain coverage for the use you intend. The delivery service you’re working for will probably deny liability, because you are not an employee unless they specifically provide coverage.

If you’re in an accident and you’re relying on your regular auto insurance coverage, your claims are likely going to be denied. Do not expect the company to validate that you have the right kind of insurance, either. That’s entirely up to you. And if you try to hide what you were doing, an insurance investigator is going to dig up the truth – which means you’re then probably on the hook for the damages and possible insurance fraud. It’s not worth it. Get the right insurance.

If I’m Delivering and I Get Injured, Can I Apply for Workers’ Compensation?

The answer is probably no if you’re an independent contractor. As an independent contractor and not an employee, you’re typically not covered by workers’ compensation benefits in the state of North Carolina. The independent contractor agreement you sign with all of these services means you’re, essentially, self-employed.

What if I’m Driving for a Delivery Service and I’m Injured by Someone Else?

Then you’re going to go after that person’s insurance. It likely will not matter to your insurer at that point, depending on the insurance rules of your state. In North Carolina, the at-fault driver’s insurance will be the one who pays, with additional liability for uninsured and underinsured drivers kicking in as necessary.

Bottom Line: Do I Want an Attorney if I’m Injured by a Rideshare or Delivery Driver?

Yes. Here’s why:

If you’re injured by one of these drivers, there might be more insurance available than the driver’s policy, but it can be a confusing process to try and figure out. The insurance company adjuster may be friendly and professional, but their interests are not the same as yours. Your attorney is on your side and has the knowledge to go head to head with the adjuster on your behalf.

You should also be aware that there is data available on the driver’s app that might show how long the driver has been driving (in case fatigue was the cause of the wreck), GPS, speed, along with other pertinent data. An experienced personal injury attorney will know how to obtain and try to preserve such evidence. Let them navigate the maze of insurance on your behalf.

The Formidable Team of Attorneys at James Scott Farrin

We have recovered more than $2 billion in gross compensation for more than 73,000 clients since 1997. And those numbers don’t include the $1.25 billion we helped recover against the U.S. government for 15,700 claimants in a historic class action case.1

In addition to their deep experience, our attorneys hold some remarkable credentials. On our team you’ll find:

- A past president of the North Carolina Advocates for Justice

- Federal law clerks

- A law school director of Legal Research and Writing

- A law school valedictorian

- Two Adjunct Professors of Law

- A former Clerk of the North Carolina Supreme Court

- A law school Associate Dean for Academic Affairs

- A former Chair of the Litigation Section of the North Carolina Bar Association

- A former state senator

- A current member of the Board of Directors of the National Organization of Social Security Disability Representatives

- Two graduates of Gerry Spence’s Trial Lawyers College

- 10 attorneys recognized by the North Carolina State Bar as Board Certified Specialists in their field

- Three former Assistant Attorneys General for the North Carolina Department of Justice

If You’re Injured in an Accident, Get a Free Case Evaluation

In 2024 alone, we recovered more than $240 million dollars in total compensation for over 5,000 clients.1 For a free case evaluation, call 1-866-900-7078 any time.