Has your car been damaged in a wreck? It may now be worth less.

You may have a diminished value claim worth pursuing. Learn more about diminished value claims in South Carolina here.

This page refers to Diminished Value Claims in South Carolina.

Since laws differ between states, if you are located in North Carolina, please click here.

Diminished Value Claims in South Carolina: What You Can Do

If you have been in an auto accident and sustained physical injuries, you are probably very concerned about how to seek compensation for your medical bills and lost wages. But did you know that you can also make a claim for the lost value, or diminished value, of your car in South Carolina?

Diminished value is the difference between the value of your car before an accident and the value of it after it has been repaired to fix any damages caused by the accident. Successful diminished value insurance claims compensate you for this decline in value.

Cars lose value when they are repaired – even if the repairs are well done – because the car’s damage history can have a negative impact on its resale value. Autotrader.com, for example, warns readers of the threat of long-lasting damage and poor repair quality if they are considering purchasing a car that has been in a wreck.

If you’ve been in an accident caused by the other driver, you should pursue a diminished value claim.

The Law Offices of James Scott Farrin is dedicated to helping injured car accident victims seek compensation from negligent drivers for their physical injuries, If you, thankfully, suffered only vehicle damage from your car wreck, here is important information on fighting for diminished value from the at-fault insurer in South Carolina.

How Does Diminished Value Work in South Carolina?

A diminished value claim may be an option for you if you did not cause the accident. In South Carolina, you can file a diminished value claim with the at-fault driver’s insurance company. If that driver is uninsured, you may be able to file a diminished value claim with your own insurance company.

In South Carolina, there are two major scenarios in which an at-fault driver can be liable to compensate you for property damage to your vehicle:

- Scenario 1: If your car is totaled, the at-fault driver is responsible for compensating you for the fair market value of your car at the time of the accident. This would not include any diminished value.

- Scenario 2: If your car is damaged but repairable, the at-fault driver is responsible for the cost of repairs and any lost value. This would likely be a diminished value case.

South Carolina also has uninsured motorist coverage (UM) for diminished value, which means that if the at-fault driver was not insured, your own UM coverage could potentially cover your diminished value claim.

How Will Someone Know My Car Was Damaged?

In South Carolina, when drivers have been in an accident and contact their insurance company, the insurance company assesses the vehicle and records the data. This information can then be accessed by companies (such as Kelley Blue Book, CarFax, AutoCheck, National Insurance Crime Bureau, VehicleHistory, and autoDNA.com) and is also made available to the public.

So, potential buyers will most likely be able to see your car’s accident history. And unfortunately, many people prefer to purchase a used car with no accident history.

How Do I Calculate Diminished Value in South Carolina?

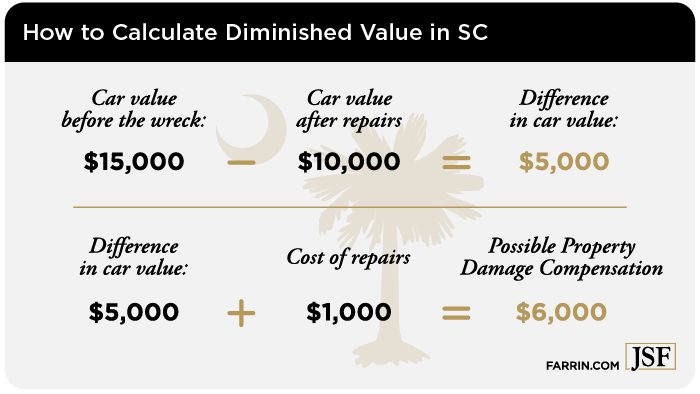

In South Carolina, if your car is repairable after the wreck, potential diminished value is calculated by subtracting the worth of the car after the accident from the worth of the car before the accident. The cost of the repairs should be added to this difference.

The following is an example of how diminished value can be calculated:

Are There Different Types of Diminished Value?

There are three main categories of diminished value:

- Inherent diminished value is the loss in value caused by the fact that the car had repairs, even if the repairs restored the car to its pre-accident condition

- Repair-related diminished value is a loss in value based on the quality of the after-accident repairs which assumes that the car cannot be fully repaired to its pre-accident condition

- Immediate diminished value is the loss in value calculated by a comparison of the car’s resale value before and after the accident

How Do I File a Diminished Value Claim in South Carolina?

In South Carolina, drivers may seek diminished value from the at-fault driver’s insurance company by following these steps:

- Determine the value of your car before the accident. You can refer to a source, such as Kelley Blue Book, to get an estimated value range

- Contact the insurance company of the at-fault driver

- Tell the insurance agent that you are filing a diminished value claim against one of their insured drivers

- Provide information requested

If the insurance company denies your claim, you can then file a claim for auto insurance arbitration in court where both you and the insurance company can present evidence to an arbitrator or arbitration panel to decide if you are owed diminished value and if so, in what amount.

Often, the insurance company may not be too interested in providing information on diminished value because it may mean more money out of their pocket.

Don’t miss out on compensation to which you may be entitled.

What Is the South Carolina Statute of Limitations for Diminished Value Claims?

The statute of limitations for diminished value claims in South Carolina is generally three years from the date that the wreck occurred, but we recommend that you act as soon as possible. If you miss the filing deadline, your claim will likely be dismissed. Also, you may hurt your case by driving your car in the meantime and further decreasing its value.

Contact the Law Offices of James Scott Farrin if You Have Been Injured in a Car Accident Caused by Another

Injured by a negligent driver?

If we help you with your injury claim, we may be able to also handle your diminished value property damage claim, too.

We want you to pursue all the compensation to which you may be entitled. It’s time to tell them you mean business.

If you’ve been hurt by a bad driver, call us today at 1-866-900-7078 or contact us online for a free case evaluation.